Incretins Under Siege? Don’t Jump To Conclusions

As a rule, prescription drugs only make news twice: when first cleared by the FDA, and when their safety profile is questioned. In diabetes treatment, Avandia, a one-time “blockbuster” drug produced by GlaxoSmithKline linked to elevated risks of heart disease, and Actos, a Takeda Pharmaceuticals product tied to significantly increased risks of bladder cancer, have generated more headlines and reports than all the combined successful uses of diabetes drugs since the discovery of insulin. Is this fair? Perhaps not. Is it reality? Absolutely. “If it bleeds, it leads” is the way many content decisions are made. This is particularly true given the almost astronomical multiplication of content sources competing for our attention during the last 15 years.

So, when the Journal of the American Medical Association {JAMA} published a study earlier this year finding that patients using glucagon-like peptide-1 (GLP-1) receptor agonists, known commercially as Byetta and Victoza, were twice as likely to be hospitalized with pancreatitis (inflammation of the pancreas) and pancreatic cancer, medical and media alarm bells sounded everywhere. But, this wasn’t a new story. Dr. Peter Butler of UCLA published Initial feedback on these risks in 2010, in an issue of the ADA’s Diabetes Care.

The JAMA article was the second in as many years reporting research that showed increased risk of pancreatitis in GLP-1s, as well as another class of type 2 drugs known as DPP-4, or dipeptidyl petidase 4 inhibitors. In the JAMA report, Januvia, a DPP-4 inhibitor, was also found to increase pancreatitis risk, while other DPP-4 inhibitors, Tradjenta and Onglyza, were found to slightly increase the same risk, but not to the extent as Byetta, Victoza, and Januvia.

Yikes! Are these five on-patent medicines, generating significant revenues for pharmaceutical behemoths like Merck (Januvia). Bristol Myers Squibb (Byetta), and Novo Nordisk (Victoza), potentially headed for the diabetes drug blacklist, joining Avandia and Actos?

Not so fast.

A Brief Introduction To GLP-1s and DPP-4 Inhibitors

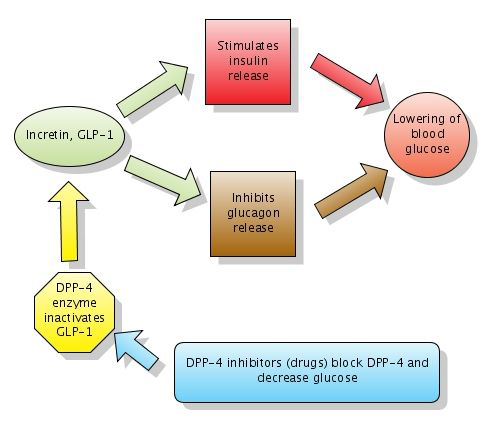

GLP-1s and DPP-4 inhibitors are relatively new drugs on the Type 2 treatment landscape. GLP-1s inhibit the action of glucagon and glucose, and thereby lower blood sugar levels. Drugs in this class slow digestion, increase a feeling of “fullness,” increase insulin secretion, and lower glucagon levels after a meal, all of which make managing blood sugars easier. Byetta, a GLP-1 injectable, was released in 2005, followed by Victoza in 2010. Some endocrinologists use Byetta as a substitute for, or a precursor to, prescribing insulin to Type 2 patients whose natural ability to secrete insulin from their pancreas has diminished.

DPP-4s were introduced in 2006 under the trade name Januvia and work similarly in the body by reducing glucagon levels. DPP-4s actually work at a level one step above GLP-1s. In the body’s natural processes, DPP-4 breaks down GLP-1s rather quickly, so DPP-4 inhibitors prevent that breakdown from happening as rapidly as normal.. In people with Type 2, GLP-1s are at lower levels than DPP-4, so the DPP-4 inhibitors can bring some balance into the glucose equation.

Which Came First – Disease Or Drug?

Although numerous studies have shown GLP-1s and DPP-4 inhibitors produce many positive results for patients, both classes of drugs have been identified as increasing the risk for pancreatitis and pancreatic cancer and come with FDA warnings to that effect. Not surprisingly, risks for pancreatitis and pancreatic cancer are higher in people with diabetes; Type 2 diabetics are almost three times as likely to suffer from pancreatitis as people who don’t have diabetes. Other studies have shown that approximately 1% of patients diagnosed with Type 2 diabetes after the age of 50 will be diagnosed with pancreatic cancer within 3 years of the initial diabetes diagnosis. So, it’s difficult to know which came first: the risk from diabetes or the risk from the diabetes drug.

The Great Study Debate

As anyone who has followed drug trials knows, there‘s always something not to like, if one chooses, in the study design, such as the way the subjects were selected, the length of time examined, and about 50 more caveats that can be used to call just about anything into doubt, or to support a positive conclusion. Commentary on GLP-1 and DPP-4 studies prove the rule.

Shortly after Byetta was released, Amylin, the company that launched and previously owned Byetta before selling its products to Bristol Myers Squibb, did a post-market study on pancreatitis. In response, UCLA’s Dr. Butler wrote in Diabetes Care that Amylin’s studies were likely not significant enough in scope to properly analyze whether or not there was a risk. “In post-marketing studies sponsored by the marketing companies, no increased signal for acute pancreatitis has been identified. However, the duration of treatment in those studies is typically short, the quality of the patient follow-up is questionable, and evidence that prescriptions were actually taken is absent,” he wrote. As noted above, this article appeared in 2010.

In the JAMA study, researchers used data from administrative insurance claims from seven Blue Cross Blue Shield Association Plans, comparing the data of 1,260 Type 2s who had pancreatitis and took the drugs to 1,260 people with diabetes who did not take them. However, this wasn’t a study specifically to look at the increased risk of pancreatitis from these drugs, so information collected by the insurance company could be either incomplete or inaccurate.

In a recent interview, Dr. Daniel Drucker of Ontario’s Samuel Lunefield Research Institute, explained that there is no biological mechanism known for why these drugs would cause pancreatitis and said that administrative database-focused research reported on in JAMA was “weak and misleading.”

A joint statement from the American Diabetes Association and the American Association of Clinical Endocrinologists concurred with Dr. Drucker’s sentiments. In their statement, they write, “This type of analysis is not considered as robust as a prospective randomized controlled clinical trial, the gold standard for evaluating treatments. There are currently nine ongoing, prospective, controlled trials of GLP-1 based therapy with over 65,000 subjects, which should provide answers to these important safety questions.” The Endocrine Society also released their own statement, echoing many of the same sentiments.

Finally, in March 2013, the FDA released a statement saying they were investigating unpublished new findings from researchers that link both GLP-1s and DPP-4s to pancreatitis and pancreatic cancer. The study was separate from the JAMA study, as the FDA was looking at findings from pancreases of deceased patients who had taken the drugs. However, the FDA emphasized that “at this time, patients should continue to take their medicine as directed until they talk to their health care professional, and health care professionals should continue to follow the prescribing recommendations in the drug labels.”

Pharma Defends Its Turf, Joins New Trials

As you would expect, the manufacturers and marketers of these drugs aren’t giving an inch. In fact, they’re choosing to participate in new clinical trials, such as those referred to above.

In an interview with Insulin Nation, Ambre Morley, Novo Nordisk’s Director of Product Communications, said, “Novo Nordisk is committed to patient safety and continuously monitors the safety profile of Victoza. We have reviewed the totality of safety information available to us, and remain confident in the safety profile of Victoza. We continue to work closely with the FDA to provide an on-going assessment of Victoza’s risk-benefit profile. We are also continuing to study Victoza in the ongoing LEADER clinical program.”

The LEADER clinical trial, while separate from the pancreatitis concerns, addresses yet another risk of type 2 drugs: cardiosvascular disease. LEADER stands for Liraglutide Effect and Action in Diabetes: Evaluation of Cardiovascular Outcome Results. The clinical trial plans to enroll 9,000 patients and study the effects of Victoza over the next 5 years.

Ken Dominski, Director of Public Affairs at Bristol Myers Squibb, stated in an interview that pancreatitis and pancreatic cancer will be part of an overall evaluation of safety in two ongoing cardiovascular clinical trials, SAVOR (for Onglyza) and EXSCEL (for Byetta). However, like Novo Nordisk, BMS maintains that there is no causal connection between Byetta and pancreatitis beyond what is already expected for people with type 2 diabetes.

What’s the Market Impact?

Are the articles and FDA advisories hurting sales? Kelly L. Close and Adam Brown, editor-in-chief and managing editor of diaTribe, a free online newsletter focused on new therapy and technology for people with diabetes, believe it’s too soon to tell.

Are the articles and FDA advisories hurting sales? Kelly L. Close and Adam Brown, editor-in-chief and managing editor of diaTribe, a free online newsletter focused on new therapy and technology for people with diabetes, believe it’s too soon to tell.

“Some companies, such as Novo Nordisk, have publicly stated (during the Q&A after their first quarter of fiscal year 2013 earnings call with analysts), that concerns about pancreatitis have not affected sales,” Close says. (In fact, Novo reported that Victoza sales increased 38% in its first fiscal quarter, according ot a recent report on trusted pharma Web site FiercePharma.com). “Other companies,” she goes on to say, “such as Merck (Januvia) and BMS/AZ (Byetta) saw lower-than-expected 1Q13 sales for their respective incretin therapies, though this could be attributed to a number of things including concerns associated with pancreatitis and pancreatic cancer, to competing therapies, to normal fluctuations in sales, or to another cause.”

It’s certainly worth adding that other major pharma players, Sanofi and Lilly to be specific, are betting that GLP-1’s have a long life ahead of them. Both companies are well down the road in bringing competitive products to market. Sanofi is already selling Lyxumia, a GLP-1 daily injectable competing with Byetta, in Europe. Victoza faces potential competition from a Lilly drug known as dulaglutide that has done well in Phase III trials and could be available in the U.S. in 2017.

According to Close, “pharma cannot do a lot besides collect more data and publish it openly. Given the benefit the drugs have provided, however, if the cases (of pancreatitis and pancreatic cancer) are actually by far too low to assess risk, we would wonder how large the danger could be to keeping them available (vs. the downside of making them unavailable for many patients that they help).”

Last Word, For Now

Even the JAMA study’s author, Dr. Sonal Singh of Johns Hopkins University School of Medicine, does not believe patients should quit taking these medications. Although he believes the link between the drugs and pancreatitis may be causal, he says, “This doesn’t mean people should stop using these drugs.”

Close, who has Type 1 diabetes, believes that it’s important to keep these drugs available while constantly re-evaluating incoming data. “At this stage, thoughtful scientists and clinicians will not change their clinical practice based on studies that have major limitations,” she says.

“That said, this is a critical issue to analyze as data emerges and we will be watching the information closely. In the meantime, we hope that major payers will be analyzing their databases and commenting on the risks,” Close concludes.

While new studies are populated and experts argue the merits or demerits of previously reported data, the best thing people taking any of the drugs mentioned in this story can do is stay in touch with their medical team and prescribing doctor. Most important, patients taking any of these drugs should be aware of the signs and symptoms for pancreatitis, which include severe nausea, vomiting and abdominal pain. Until further notice, the medical and regulatory communities have decided that reward outweighs risk when it comes to using GLP-1s and DPP-4s.