Can Companion Medical Save Medtronic Diabetes?

Medtronic hopes InPen can help regain their place in the T1D market, but success will only come if Medtronic repairs its current shortcomings

Since the release of Tandem’s Control IQ earlier this year, Medtronic Diabetes has been floundering in the pump market, losing close to a point of market share each month.

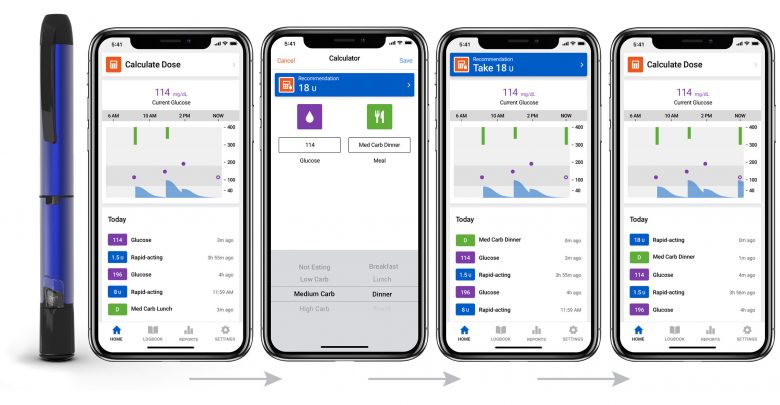

In an attempt to reverse this trend and focus on other areas of the diabetes market, the company has acquired Companion Medical, the makers of InPen. The InPen is the only FDA approved smartpen and is capable of tracking insulin onboard and calculating meal boluses through its connected app.

While the move comes as a surprise to those tracking Medtronic’s future goals–which lie mostly in improving their hybrid-closed loop pump–focusing on the MDI market may actually be Medtronic’s best chance at survival.

Is There a Medtronic Future in the MDI Market?

Only about 20% to 30% of type 1 diabetics rely on insulin pumps for their insulin therapy. That means there are about one million Americans who utilize multiple daily injections (MDI) to control their blood sugar.

Medtronic Diabetes has failed to overwhelm those type 1s who do rely on insulin pumps. The company is clearly betting that this acquisition provides an opportunity to do better in the MDI market.

The InPen provides a high-tech solution for people who are interested in simplifying their insulin treatment but aren’t ready or aren’t financially able to commit to a pump. Medtronic plans to incentivize this baby step away from traditional insulin pens by integrating it with their CGM system to allow for greater control with less effort.

As Sean Salmon, the President of the Diabetes Group at Medtronic puts it:

“This acquisition is an ideal strategic fit for Medtronic as we further simplify diabetes management and improve outcomes by optimizing dosing decisions for the large number of people using multiple daily injections (MDI). We look forward to building upon the success of the InPen by combining it with our intelligent algorithms to deliver proactive dosing advice personalized to each individual. This smart CGM system can help people think less about diabetes and be able to live life with more freedom, on their own terms. Our goal is to become a trusted partner that offers consistent support whether an individual wants to stay on MDI, transition to automated insulin delivery, or take a break from their pump.”

The terms of the acquisition have not been released but the 2019 revenue for Companion Medical has been estimated at around $11 million, according to Fierce Biotech.

Keys to Medtronic InPen Success

Medtronic expects to use its extensive sales organization to expand the market for InPen. Financial analysts expect the deal could add up to $200 million in incremental revenue for the company

This growth prediction assumes that Medtronic is able to successfully market the pen as a more valuable alternative to traditional pens.

- Price-wise, this shouldn’t be a hard sell.

- The InPen is currently covered by most insurance companies and 70% of those who get one pay less than a $70 copay for it.

- The member coverage for the InPen is only expected to increase once the sale to Medtronic is finalized.

Even the out of pocket cash cost of the current InPen is only about $549. Considering that a prefilled box of Humalog pens costs over $600 and that each InPen lasts about a year, switching to this smartpen isn’t likely to cost a person much more than they would spend on traditional pens anyway.

Changing Habits with Better Value?

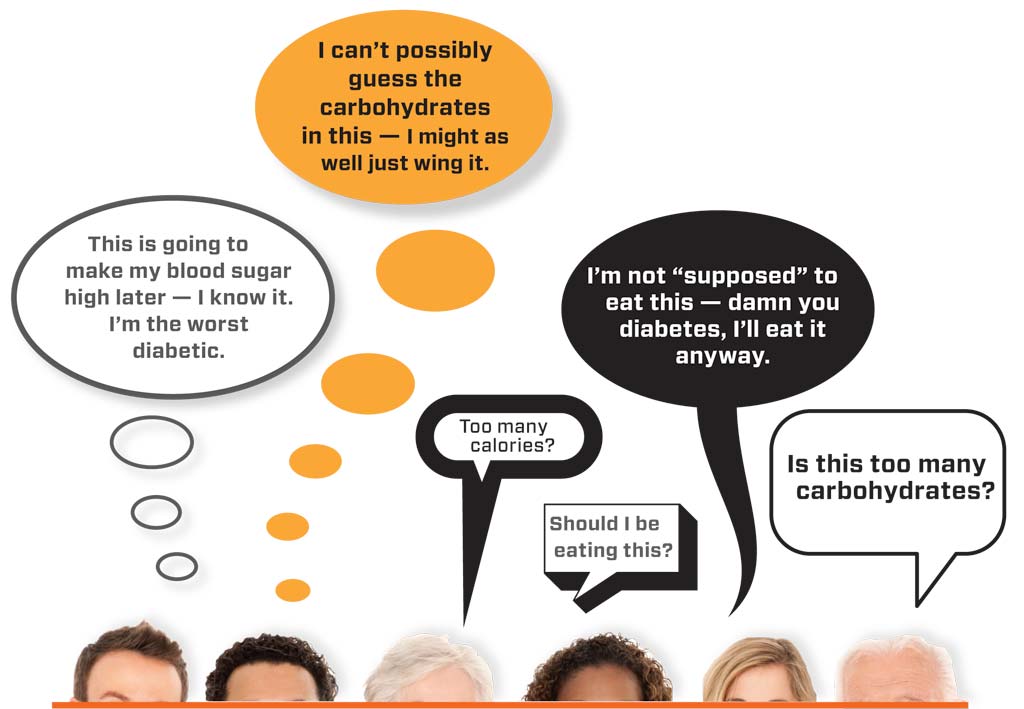

While getting younger people, many of whom start off on pens, to switch from traditional MDI to a smartpen isn’t likely to take much, getting older MDI users on board could be a tougher sell.

- Many diabetes veterans use pens because they aren’t interested in the technology a pump can bring.

- Often, they have been calculating their boluses and estimating their insulin on board for so long, that there just isn’t a lot of appeal in a more complicated device that can do the same.

Pairing the InPen with an easy-to-use, highly-accurate CGM might help change the perceived value for even tenured T1s.

But this is an area where Medtronic has failed in the past.

While the Medtronic 670g pump is by no means perfect, it may be their CGM lines that truly cost them their top position in the diabetes world.

The only way adding CGM to their new smartpen will work as an incentive is if Medtronic can deliver on the promises they originally made for their GS3 sensor.

- This next-generation CGM sensor was supposed to be more accurate, provide non-adjunctive readings, and only require calibration on the first day of use.

- Unfortunately, the only thing that improved with the launch of the GS3 was the accuracy.

- The new CGM still requires finger-poke testing for treatment decisions and must be calibrated multiple times each day.

It may be possible for Medtronic to use their acquisition of Companion Medical and its focus on the highly profitable MDI sector to regain some ground in the type 1 diabetes market, but first, Medtronic must fix the mistakes that cost them their top-seat in the first place.